In North Carolina, like in many states, the concept of Diminished Value (DV) plays a significant role for vehicle owners following an accident.

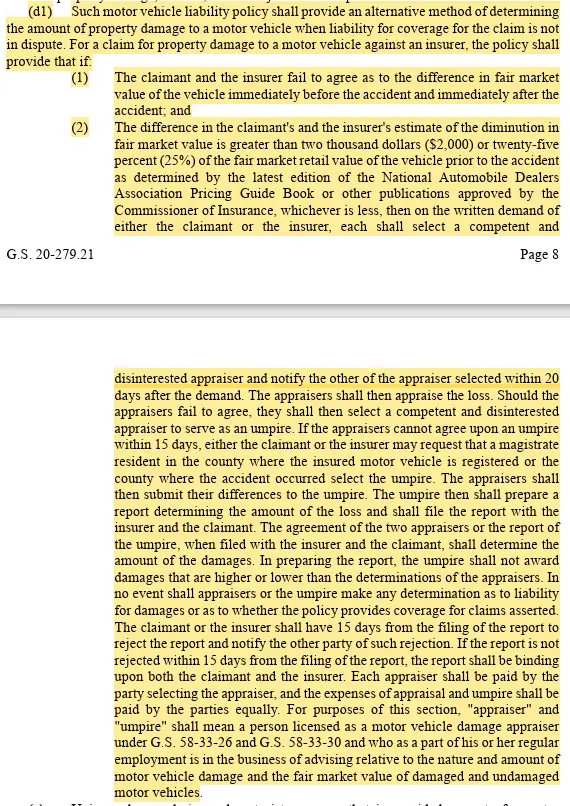

Given the legal landscape outlined by statutes such as G.S. 20-279.21, understanding DV in NC is essential for consumers looking to recoup the full range of losses that can occur when their vehicle is damaged and repaired.

The Basis of Diminished Value in North Carolina

North Carolina law acknowledges the right of a vehicle owner to recover the diminished value of their vehicle after an accident caused by another party.

This recognition is rooted in the principle that the compensation for damages due to an auto accident should not only cover the costs of repairs but also the loss in value the vehicle suffers as a result of having been involved in an accident.

How Diminished Value Works in NC

Eligibility for DV Claims: In NC, to be eligible for a DV claim, the damage to your vehicle must have been caused by another party who is at fault. The DV claim is usually filed against the at-fault party’s insurance company.

Types of Diminished Value: North Carolina primarily focuses on Inherent Diminished Value, which is the loss in value of a vehicle due to it having an accident history, even after repairs are done professionally.

Filing a Claim: Filing a DV claim in NC involves gathering necessary documentation, including repair records, a professional DV appraisal, and potentially a Carfax report or similar to show your vehicle’s history. The claim is then presented to the at-fault party’s insurance provider.

Statute Limitations: It’s crucial to be aware of the statute of limitations for filing a DV claim in NC. Typically, you have three years from the date of the accident to file a property damage claim, which includes DV.

Challenges and Considerations

While the statute provides a framework for recovering DV, challenges remain. Insurance companies may dispute the amount of diminished value claimed, requiring negotiation or even legal action.

Consumers may need to enlist the help of professional appraisers or attorneys specializing in DV claims to accurately assess the loss and navigate the claims process.

Consumer Rights Under G.S. 20-279.21

G.S. 20-279.21 outlines the obligations of insurance companies regarding motor vehicle liability policies. While it primarily details insurance coverage requirements, understanding your rights under this and related statutes is crucial when entering into negotiations with insurance companies over DV claims.

Conclusion

For North Carolina residents, the ability to claim diminished value offers a path to recover the true cost of an accident.

However, success requires an understanding of the state’s legal landscape, meticulous documentation, and sometimes negotiation or legal representation.

As a consumer, being informed and prepared can make all the difference in ensuring you are fully compensated for your loss.